Sales Tax Calculator Ohio

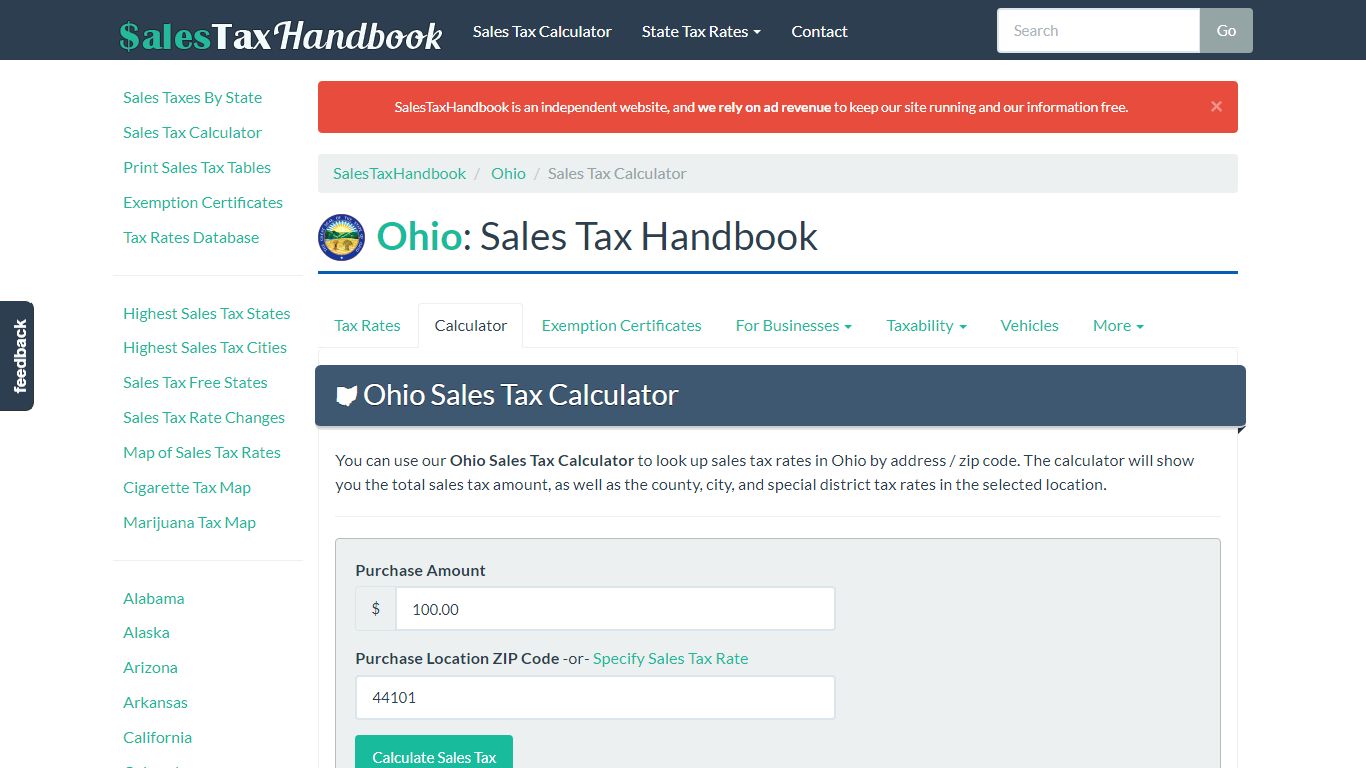

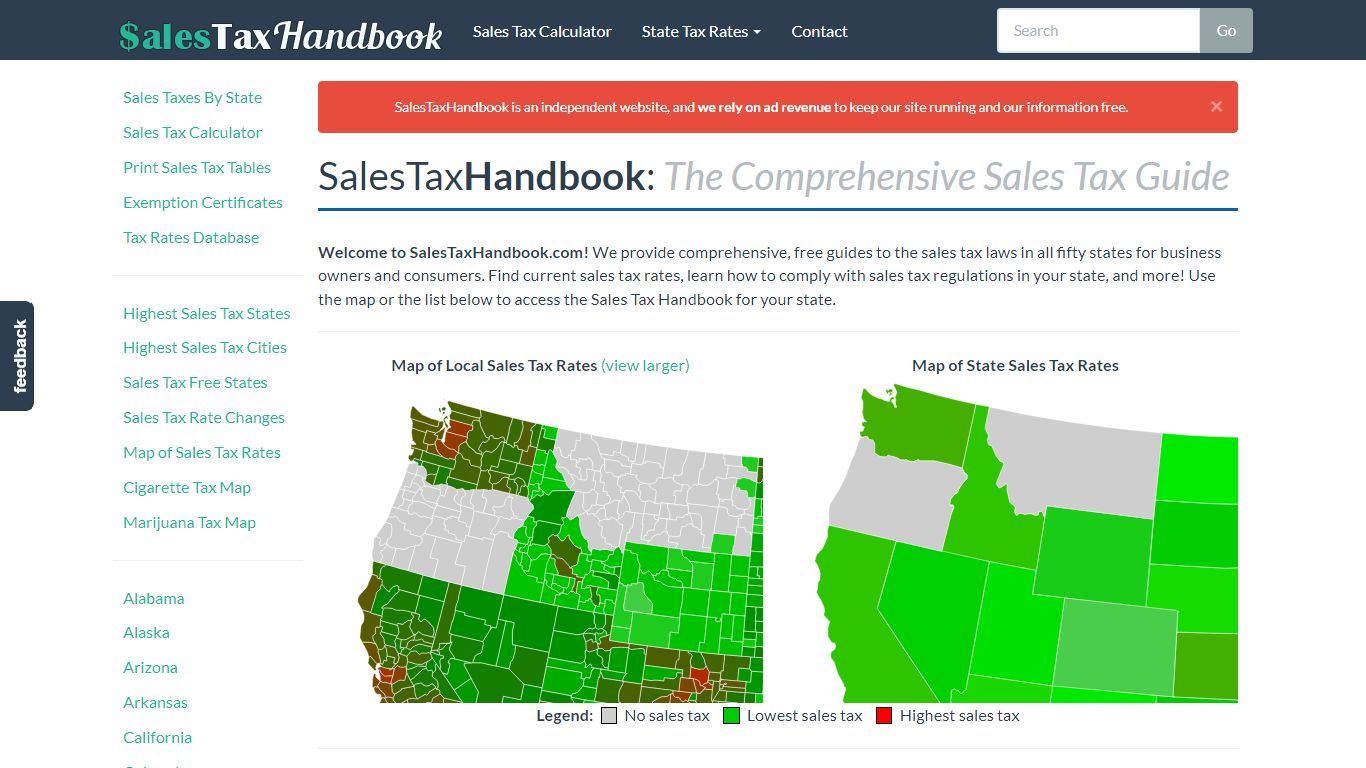

Ohio Sales Tax Calculator - SalesTaxHandbook

Ohio Sales Tax Calculator You can use our Ohio Sales Tax Calculator to look up sales tax rates in Ohio by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/ohio/calculator

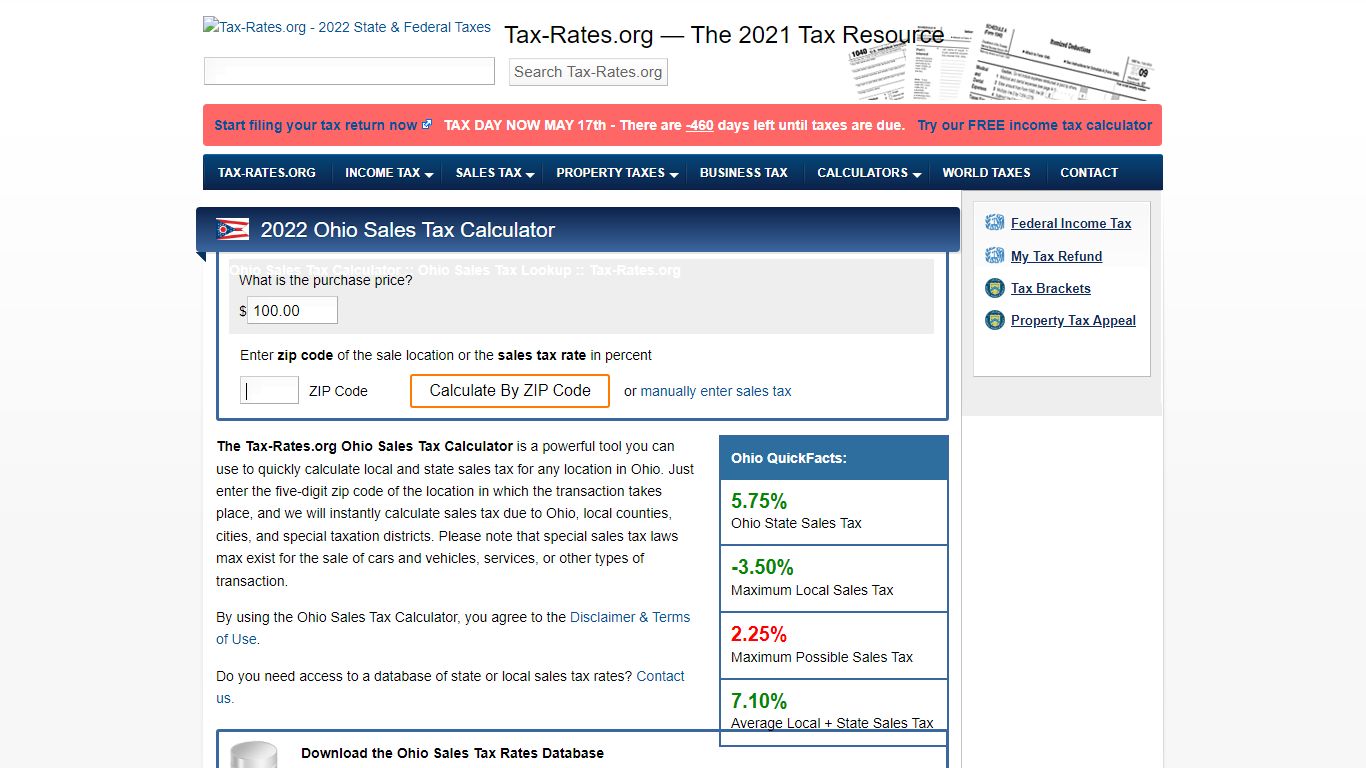

Ohio Sales Tax Calculator - Tax-Rates.org

The Tax-Rates.org Ohio Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Ohio. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Ohio, local counties, cities, and special taxation districts.

https://www.tax-rates.org/ohio/sales-tax-calculator

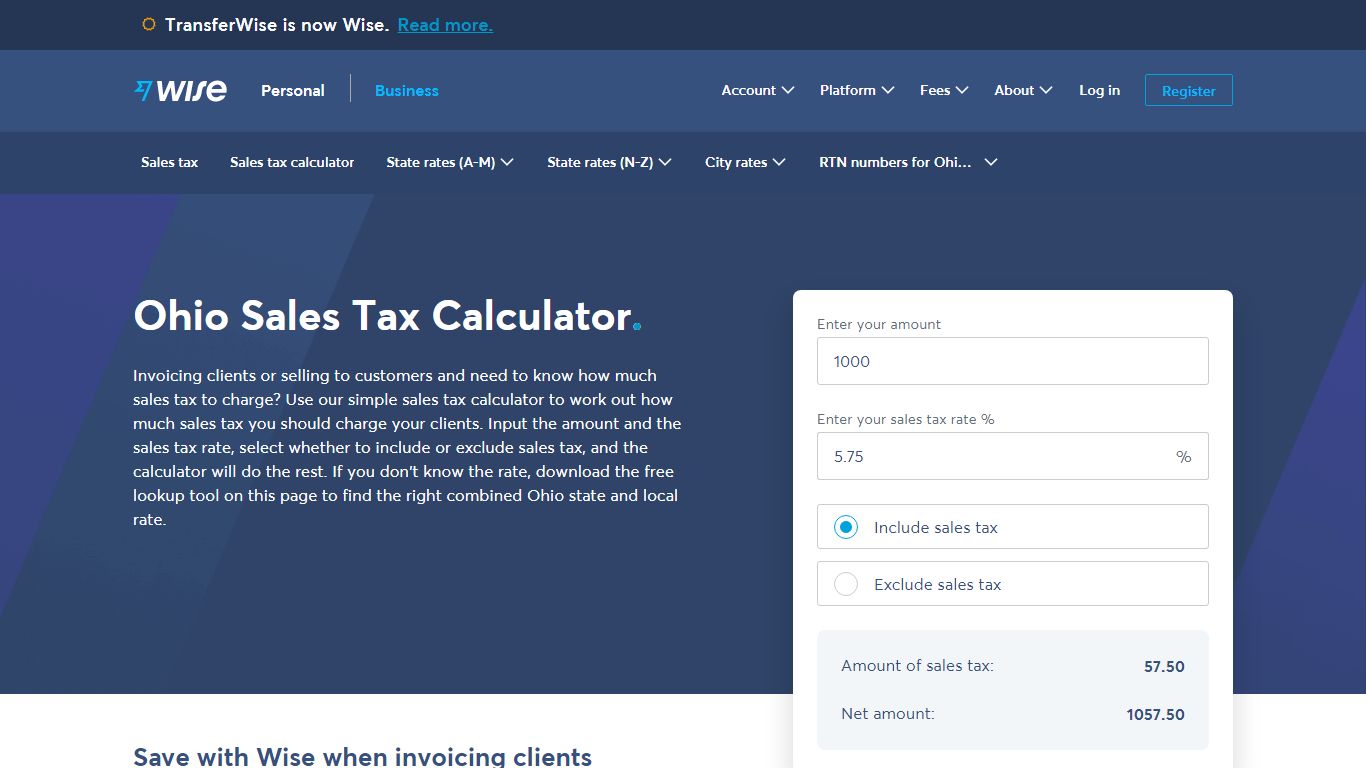

Ohio Sales Tax | Calculator and Local Rates | 2021 - Wise

Local tax rates in Ohio range from 0% to 2.25%, making the sales tax range in Ohio 5.75% to 8%. Find your Ohio combined state and local tax rate. Ohio sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. That’s why we came up with this handy Ohio sales tax calculator.

https://wise.com/us/business/sales-tax/ohio

Sales & Use Tax - Ohio Department of Taxation

The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer. The state sales and use tax rate is 5.75 percent.

https://tax.ohio.gov/sales_and_use.aspx

Sales & Use Tax - Ohio Department of Taxation

The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer. The state sales and use tax rate is 5.75 percent.

https://tax.ohio.gov/business/ohio-business-taxes/sales-and-use

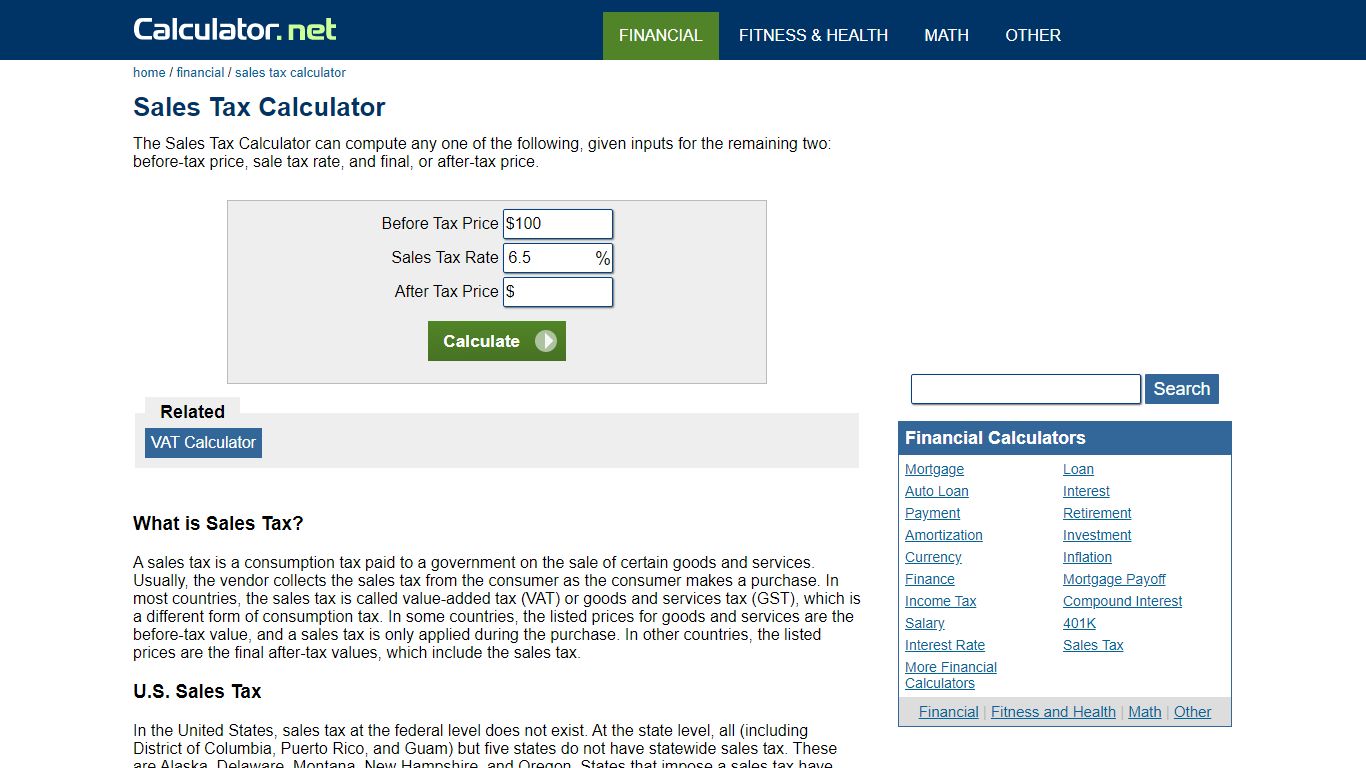

Sales Tax Calculator

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax? A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

https://www.calculator.net/sales-tax-calculator.html

Ohio Sales Tax Table for 2022 - SalesTaxHandbook

The state sales tax rate in Ohio is 5.75%, but you can customize this table as needed to reflect your applicable local sales tax rate . Tax Rate Starting Price Price Increment Ohio Sales Tax Table at 7.25% - Prices from $5,663.80 to $5,710.60 Print This Table | Next Table (starting at $5,710.60) Price Tax 5,663.80 0.36 5.20 0.38 5.40 0.39 5.60 0.41

https://www.salestaxhandbook.com/ohio/sales-tax-table?rate=7.25&increment=0.2&starting=5663.8

Vandalia, Ohio Sales Tax Calculator (2022) - Investomatica

Sales Tax Calculator Calculate Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Vandalia, Ohio. You'll then get results that can help provide you a better idea of what to expect. 7.5% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/ohio/vandalia

ohio sales tax calculator - Search

Calculate Sales and Use Tax - Get Started Is Easy. Ad https://www.avalara.com. People also ask. What is the individual tax rate in Ohio? What is the individual tax rate in Ohio? ...

https://chipnation.org/ohio+sales+tax+calculator&FORM=QSRE7

Ohio Vehicle Sales Tax & Fees [+ Calculator] - Find The Best Car Price

How to Calculate Ohio Sales Tax on a Car To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 5.75%. Multiply the vehicle price (after trade-in but before incentives) by the sales tax fee. For example, imagine you are purchasing a vehicle for $50,000 with the state sales tax of 5.75%.

https://www.findthebestcarprice.com/ohio-vehicle-sales-tax-fees/![Ohio Vehicle Sales Tax & Fees [+ Calculator] - Find The Best Car Price](./screenshots/sales-tax-calculator-ohio/9.jpg)

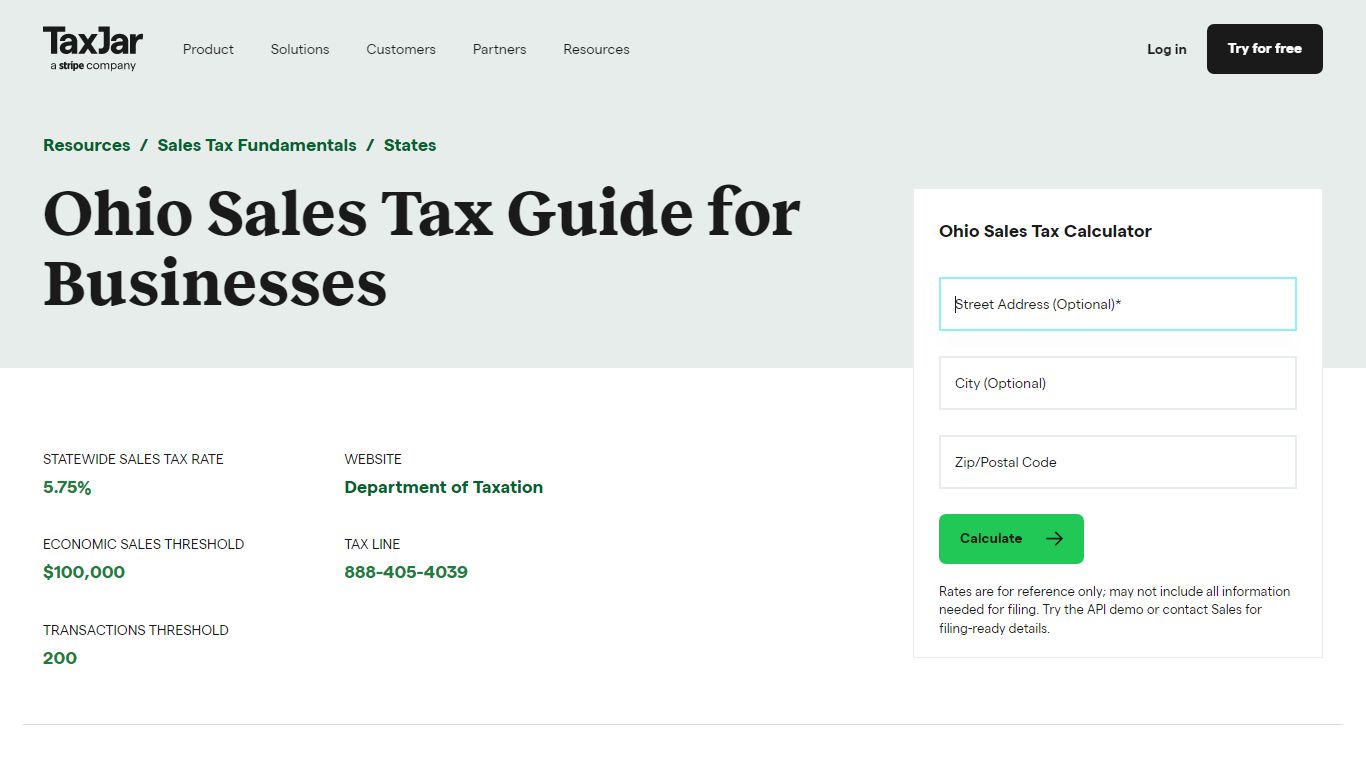

Ohio Sales Tax Guide and Calculator 2022 - TaxJar

Collect sales tax at the tax rate where your business is located. The state sales tax rate (and use tax rate) in Ohio is 5.75%. You can look up your local sales and use tax rates with TaxJar’s Sales Tax Calculator. In Akron, for example, there’s a total sales tax rate of 6.75% – due to an additional 1% due for sales in Summit County.

https://www.taxjar.com/sales-tax/ohio